Calculate the following financial ratios for phone corporation – Financial ratios are indispensable tools for analyzing the financial performance of phone corporations, enabling investors, analysts, and management to make informed decisions. This guide provides a comprehensive overview of the various financial ratios used to assess liquidity, solvency, profitability, efficiency, and market value, empowering you to gain a deeper understanding of a phone corporation’s financial health.

Understanding industry benchmarks is crucial for meaningful interpretation of financial ratios, as they provide a context for comparison and highlight areas where a phone corporation may excel or fall short.

Financial Ratios for Phone Corporation: Calculate The Following Financial Ratios For Phone Corporation

Financial ratios are essential tools for analyzing the financial performance of a phone corporation. They provide insights into various aspects of the company’s financial health, including liquidity, solvency, profitability, efficiency, and market value.

Using industry benchmarks for comparison is crucial to determine how a phone corporation stacks up against its peers. Benchmarks provide context and help identify areas where the company excels or needs improvement.

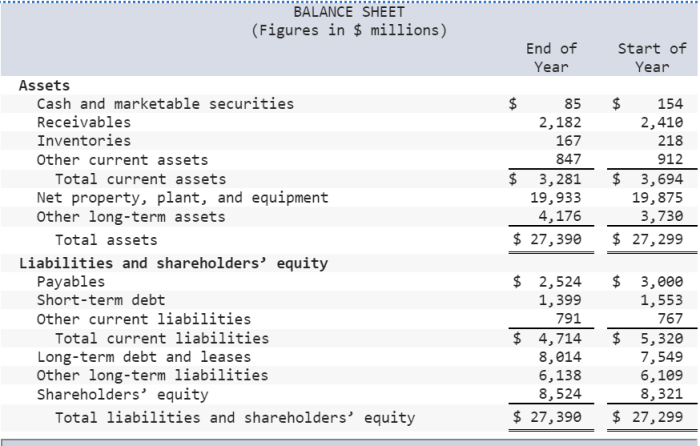

Liquidity Ratios

Liquidity ratios measure a phone corporation’s ability to meet its short-term obligations. They indicate whether the company has sufficient liquid assets to cover its current liabilities.

- Current Ratio:Assets / Current Liabilities

- Quick Ratio (Acid-Test Ratio):(Cash + Cash Equivalents + Marketable Securities) / Current Liabilities

A high current ratio indicates a company’s ability to meet its short-term obligations. A quick ratio focuses on the most liquid assets, providing a more stringent assessment of liquidity.

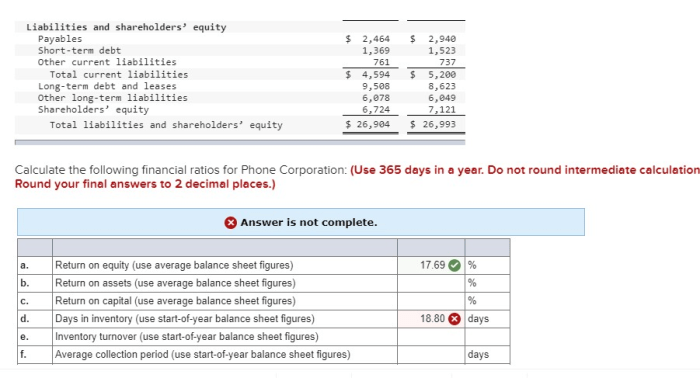

Solvency Ratios

Solvency ratios assess a phone corporation’s ability to meet its long-term obligations. They indicate whether the company has a sound financial structure and can withstand financial stress.

- Debt-to-Equity Ratio:Total Debt / Shareholder Equity

- Times Interest Earned Ratio:Net Income / Interest Expense

A low debt-to-equity ratio indicates a company’s financial leverage is manageable. A high times interest earned ratio suggests a company’s ability to cover its interest payments.

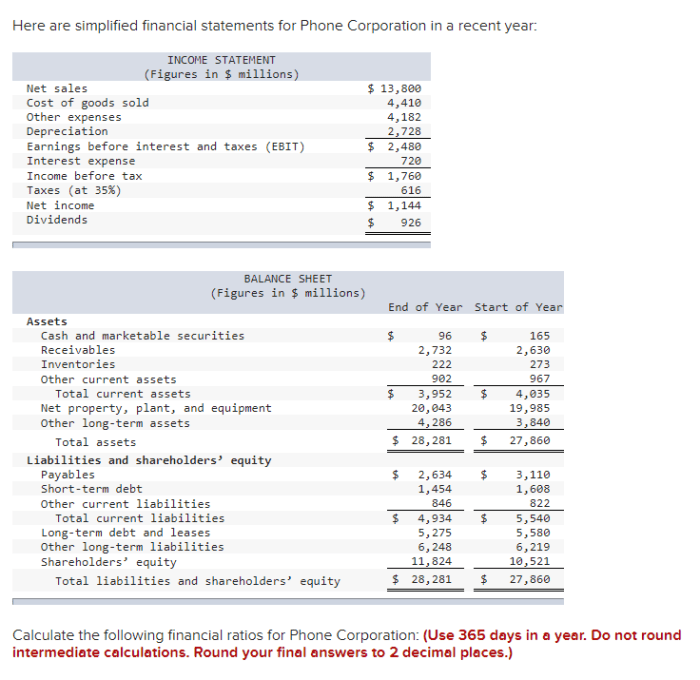

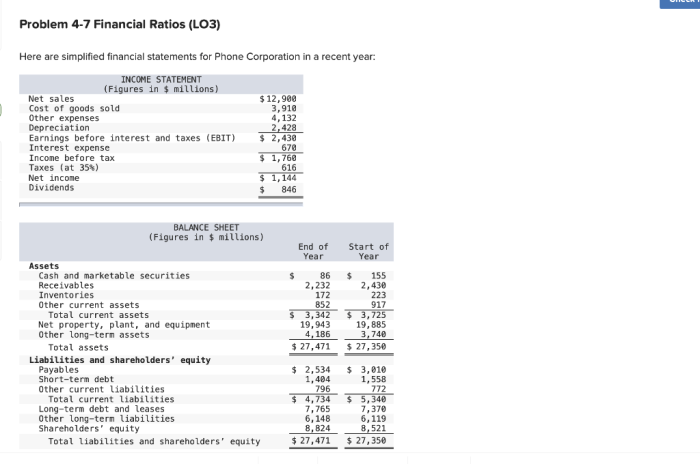

Profitability Ratios

Profitability ratios measure a phone corporation’s ability to generate profits. They indicate the company’s efficiency in using its assets and generating revenue.

- Gross Profit Margin:Gross Profit / Revenue

- Net Profit Margin:Net Income / Revenue

A high gross profit margin indicates a company’s ability to generate revenue from its sales. A high net profit margin reflects the company’s overall profitability.

Efficiency Ratios

Efficiency ratios measure a phone corporation’s ability to manage its assets and operations efficiently. They indicate how well the company uses its resources to generate revenue.

- Inventory Turnover Ratio:Cost of Goods Sold / Average Inventory

- Accounts Receivable Turnover Ratio:Net Credit Sales / Average Accounts Receivable

A high inventory turnover ratio indicates a company’s ability to manage its inventory efficiently. A high accounts receivable turnover ratio reflects the company’s effectiveness in collecting its receivables.

Market Value Ratios, Calculate the following financial ratios for phone corporation

Market value ratios assess a phone corporation’s market performance. They indicate how investors perceive the company’s value and potential.

- Price-to-Earnings Ratio (P/E Ratio):Market Value of Equity / Earnings Per Share

- Price-to-Book Ratio (P/B Ratio):Market Value of Equity / Book Value of Equity

A high P/E ratio indicates investors’ confidence in a company’s growth prospects. A high P/B ratio suggests that the market values the company’s assets more than its book value.

Helpful Answers

What is the purpose of calculating financial ratios?

Financial ratios provide insights into a phone corporation’s financial performance, allowing stakeholders to assess its liquidity, solvency, profitability, efficiency, and market value.

Why is it important to use industry benchmarks when analyzing financial ratios?

Industry benchmarks provide a context for comparison, enabling stakeholders to identify areas where a phone corporation may excel or fall short relative to its peers.

What are some examples of liquidity ratios?

Common liquidity ratios include the current ratio and quick ratio, which measure a phone corporation’s ability to meet short-term obligations.